The Democratic Republic of the Congo Triples the Royalty Rate for Cobalt

Cobalt is a major component in the batteries that EVs use, and its increasing price could hinder EV development

Numerous automakers are predicting that electric vehicles will be the future of the industry, and have adjusted their product strategies accordingly. However, any number of factors could affect their efforts to develop such vehicles.

The latest obstacle for EV developers to overcome is an increased royalty rate on cobalt imposed by the Democratic Republic of the Congo.

EV Accomplishments: Energy-saving Chevrolet Bolt has already spared 175K gallons of gas

The Democratic Republic of the Congo’s Prime Minister Bruno Tshibala recently signed a new decree that nearly triples the royalty rate that miners have to pay for cobalt. Prior to the decree, the royalty rate was right at 3.5 percent. Now, that rate has been increased to 10 percent.

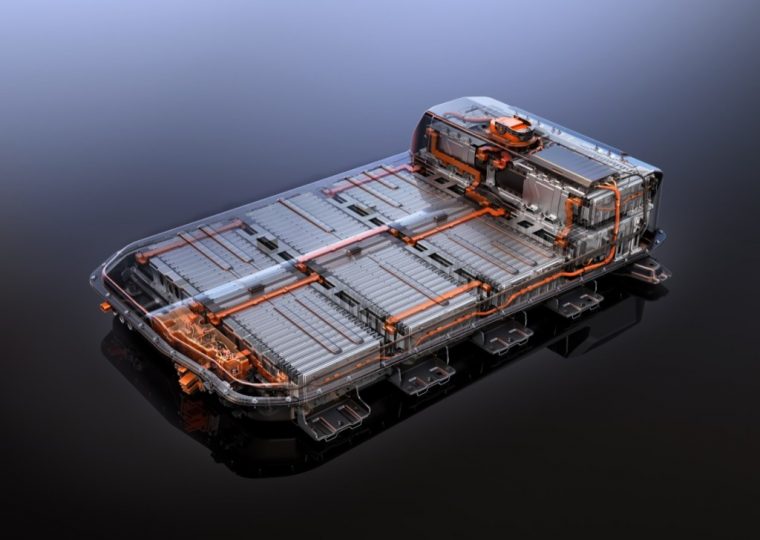

Cobalt is a major component in the batteries utilized by electric vehicles. If miners have to pay more for the substance, those costs will be carried over to automakers, which will in turn increase the asking prices of their EVs.

Prime Minister Tshibala also increased the royalty rate for coltan to 10 percent. Coltan is used to power several electronic devices.

Advanced Vehicle Developments: What is Magnetic Ride Control?

Miners and automakers don’t have a lot of other options when it comes to cobalt supplies. The Democratic Republic of the Congo mines more than 60 percent of the world’s cobalt.

For the past few years, the price of cobalt has been on the rise, thanks in part to an increasing demand from automakers developing EVs. While cobalt prices fell roughly 40 percent earlier this year due to a surplus of cobalt chemicals, it would seem the price of the material is back on the rise for the foreseeable future.

News Source: Reuters

The News Wheel is a digital auto magazine providing readers with a fresh perspective on the latest car news. We’re located in the heart of America (Dayton, Ohio) and our goal is to deliver an entertaining and informative perspective on what’s trending in the automotive world. See more articles from The News Wheel.