While the global auto industry pushes toward electrification, BMW is choosing a more flexible path. The German automaker is keeping its combustion engine options open, reinforcing its “Power of Choice” strategy in response to real-world consumer preferences and uneven market readiness for electric vehicles.

This decision reveals the tensions between policy-driven electrification goals and actual customer behavior. Although regulatory frameworks, especially in Europe, are tightening around emissions and internal combustion engines, many buyers, particularly in the premium segment, still prefer traditional engine performance. BMW’s pivot reflects the reality that the market isn’t shifting at the same pace everywhere.

End-of-Line Plans Interrupted by Consumer Demand

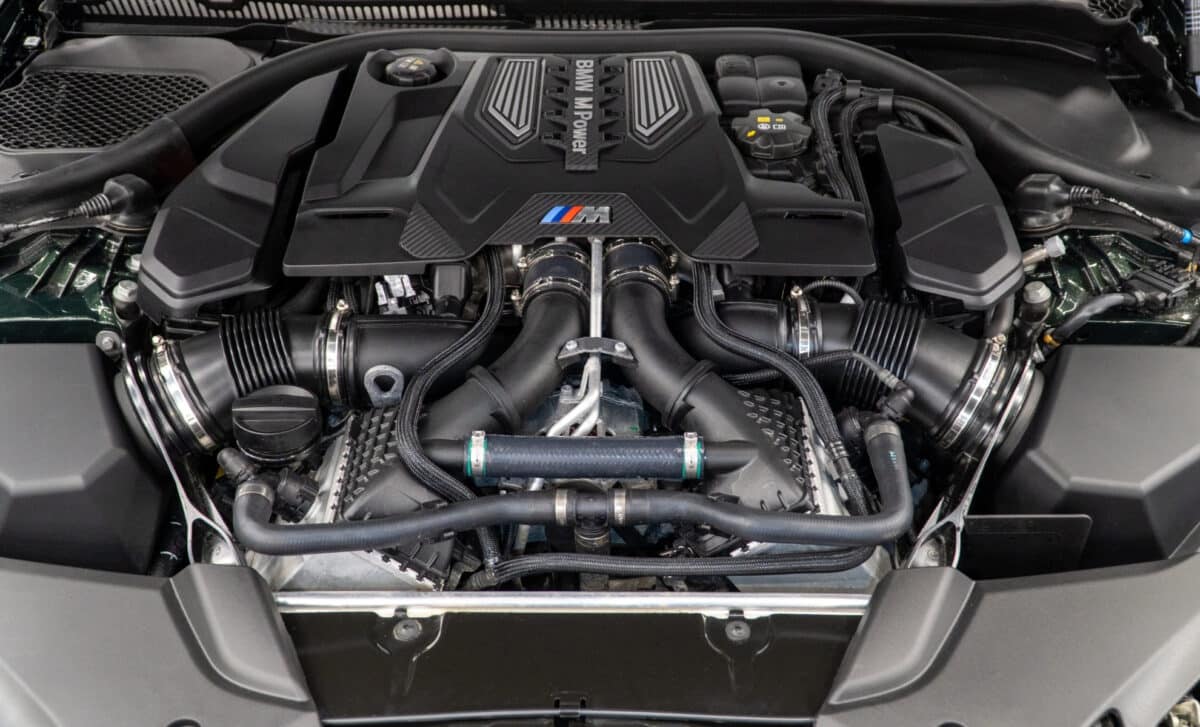

BMW had made clear moves to retire its V8 and V12 blocks. The V12 disappeared from the European catalog in 2022 with the end of the M760Li, surviving only in select Rolls-Royce models. Meanwhile, the last V8 engine built at BMW’s Munich plant rolled off the line in late 2023, with assembly lines set to close in January 2026 to make room for the fully electric Neue Klasse lineup.

This schedule aligned with European emissions legislation, including the expected 2035 combustion engine ban and the arrival of the Euro 7 norms. Everything indicated that BMW would soon turn the page on high-displacement combustion engines.

Yet market data from 2025 showed a different reality. Fully electric vehicles represented just 18% of BMW’s global deliveries that year, while electrified models, including hybrids, reached 26%. The overwhelming majority of buyers still opted for gasoline-powered vehicles. This discrepancy triggered a strategic shift at BMW, fueled primarily by persistent demand in the United States.

U.S. Market Drives Production Relocation

The appetite for V8 models remained “above average” in the U.S., according to a BMW spokesperson quoted by Automotive News Europe. This strong market pull led the brand to reorganize its production strategy rather than phase out the engines altogether.

BMW has now relocated V8 engine assembly to its Hams Hall facility in the United Kingdom, while the plant in Steyr, Austria, will continue producing some components until the end of 2025. In Munich, about 400 employees remain dedicated to manufacturing vital parts such as crankshafts, cylinder heads, and casings, although no new deadline has been set for the final end of combustion engine production.

This reorganization allows BMW to continue equipping several flagship models with V8 engines. These include the BMW X5, X6, and X7, primarily for the North American and Middle Eastern markets, the facelifted 7 Series and its Alpina V8 variants, the upcoming M5, and several Rolls-Royce vehicles.

French Restrictions Limit Local Availability

In contrast to the U.S. and Middle East, France presents an increasingly hostile environment for high-displacement combustion engines. CO₂-related taxes, horsepower-based penalties, and the spread of low-emission zones (ZFE) have sharply narrowed the availability of such models in the French market.

The combination of policy pressures has made it economically impractical to offer V8 and V12-equipped vehicles widely in France. This regulatory divergence illustrates the growing imbalance between different regions’ approach to mobility and emissions.

While BMW’s revised strategy provides flexibility for global markets, the company must also navigate tightening rules in Europe. The shift highlights the complexity of transitioning toward electric mobility while maintaining a competitive edge in performance and luxury segments that still rely on internal combustion. BMW has not confirmed any new phase-out dates for its V8 and V12 engines.