The company argues that such a policy could harm the industry and undermine its transition to a more sustainable future. The call for a reformed law comes as the EU’s decision to phase out combustion engines is fast approaching, sparking fierce debate over its implications for automakers and the broader economy.

The EU has already set ambitious targets for reducing fleet emissions across the automotive sector. These goals, while aimed at accelerating the transition to cleaner vehicles, have raised concerns among manufacturers like Stellantis, which own multiple well-known car brands. The company’s chairman, John Elkann, emphasized the need for a re-think of the 2035 ban, suggesting that more time and flexibility could enable a smoother transition for the industry.

The debate intensifies as the European market struggles to fully embrace electric vehicles (EVs). While EV sales are expected to grow, many automakers believe the proposed ban could cause significant disruption. Stellantis, in particular, is pushing for changes to ensure a balanced path forward, one that considers both technological innovation and economic stability.

Stellantis’ Opposition to the ICE Ban

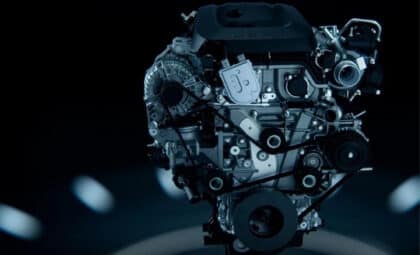

Stellantis has been vocal in its opposition to the EU’s 2035 combustion engine ban, particularly when it comes to plug-in hybrids and range-extending electric vehicles (EVs). According to Elkann, these vehicles, which combine a combustion engine with an electric motor to reduce emissions, should be allowed to continue beyond the set cut-off date.

He argues that these vehicles, often seen as a bridge between traditional engines and fully electric cars, have an essential role in the transition to a more sustainable automotive future. Elkann also pointed to the potential of alternative fuels as another avenue for decarbonization, reinforcing the need for a broader, more flexible strategy, reports Motor1.

Emissions Targets and Industry Concerns

Alongside the ban, the EU has set increasingly stringent fleet emissions targets for carmakers. By 2025, automakers are required to reduce fleet emissions by 15 percent compared to the 2020-2024 period. While the EU has granted some leniency, the upcoming 2030 target is expected to be even more demanding, aiming for a reduction to 49.5 grams of CO2 per kilometer.

Stellantis, however, believes these targets could be too harsh, particularly with the EU’s previous expectation that carmakers meet annual emissions limits starting in 2030. Elkann has proposed that the industry be given more time and allowed to average emissions over a five-year period from 2028 to 2032, giving manufacturers a better chance to adapt.

The Shift Toward EVs and Market Realities

The transition to electric vehicles is a key component of the EU’s environmental strategy, but the shift is far from complete. As of September 2023, electric vehicles made up only 16.1 percent of the total car sales in the EU, indicating that adoption is still in its early stages.

According to the European Automobile Manufacturers’ Association (ACEA), the jump to 100 percent EV sales by 2035 is seen as highly ambitious. Many believe it would be unrealistic to expect the entire market to shift so quickly, potentially jeopardizing jobs and causing significant economic disruption. This concern is echoed by executives from other major automakers, including BMW and Mercedes-Benz, who warn that such a sudden push for EV adoption could “kill an industry.”

The market, however, is expected to evolve with the arrival of more affordable electric vehicles. Renault, for example, has recently introduced its sub-€20,000 Twingo, while Volkswagen plans to launch its €25,000 ID. Polo in 2026. Stellantis, too, is responding to the challenge with the Citroën ë-C3, a budget-friendly EV priced under €20,000. These moves signal a growing recognition that affordability will be a key driver of EV adoption, but whether this will be enough to meet the 2035 target remains uncertain.