Consider everything that affects your auto financing options before making a purchase

Consider everything that affects your auto financing options before making a purchase

If you are in the market for a new or used car, you can usually get a better deal at a dealership if you agree to finance the purchase with an auto loan.

Before deciding to finance your car, though, you need to know what factors impact the offer you’ll receive from the lender. There are many different things that go into loan calculations, but these three that impact your auto financing options the most.

Financing Resources: Answers to the most-asked questions about vehicle financing

If you’ve done any research into buying a car before, you already know that your credit score is a huge deal. This shouldn’t be a surprise.

This is the primary factor lenders consider to calculate your financing offers, so you should be familiar with your credit history and if it needs to be improved first. Otherwise, you may take on a high-interest loan that you won’t be able to afford. You can get free annual credit reports from reputable sources to monitor its state on a regular basis.

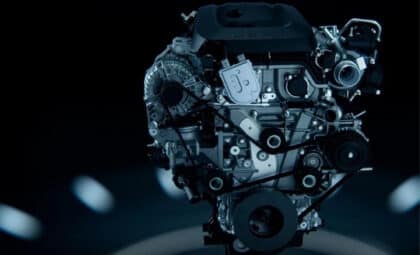

If you are looking for an economy sedan or SUV from a mainstream automaker, you can expect better financing rates than you might get for buying a convertible or a luxury vehicle.

That’s because the lower the value of the car, the more likely you’ll pay it off. The lower risk you are, the better rate you’ll be offered. So, if you want to keep rates low, research what kinds of cars are the more affordable to finance before you start your hunt.

Buying a Used Car: Advice for getting the best deal with the least problems

According to the Federal Trade Commission, there are many requirements for auto financing, and steady employment is one of them. Why? Lenders want to confirm that they’re not giving money to someone who will struggle to repay them. Defaulting on a loan isn’t good for anyone involved!

The specific needs will vary by lender, but you can expect most financiers to ask for proof of employment and pay stubs or an equivalent proof of income. In addition, a lender may go through additional verification steps to ensure that your stated income is accurate.

Being informed is the first step to getting a good rate on your auto loan, so always do your research prior to officially applying for financing. Hopefully, this will guide to having lower monthly payments for the car you want.

Aaron is unashamed to be a native Clevelander and the proud driver of a Hyundai Veloster Turbo (which recently replaced his 1995 Saturn SC-2). He gleefully utilizes his background in theater, literature, and communication to dramatically recite his own articles to nearby youth. Mr. Widmar happily resides in Dayton, Ohio with his magnificent wife, Vicki, but is often on the road with her exploring new destinations. Aaron has high aspirations for his writing career but often gets distracted pondering the profound nature of the human condition and forgets what he was writing… See more articles by Aaron.