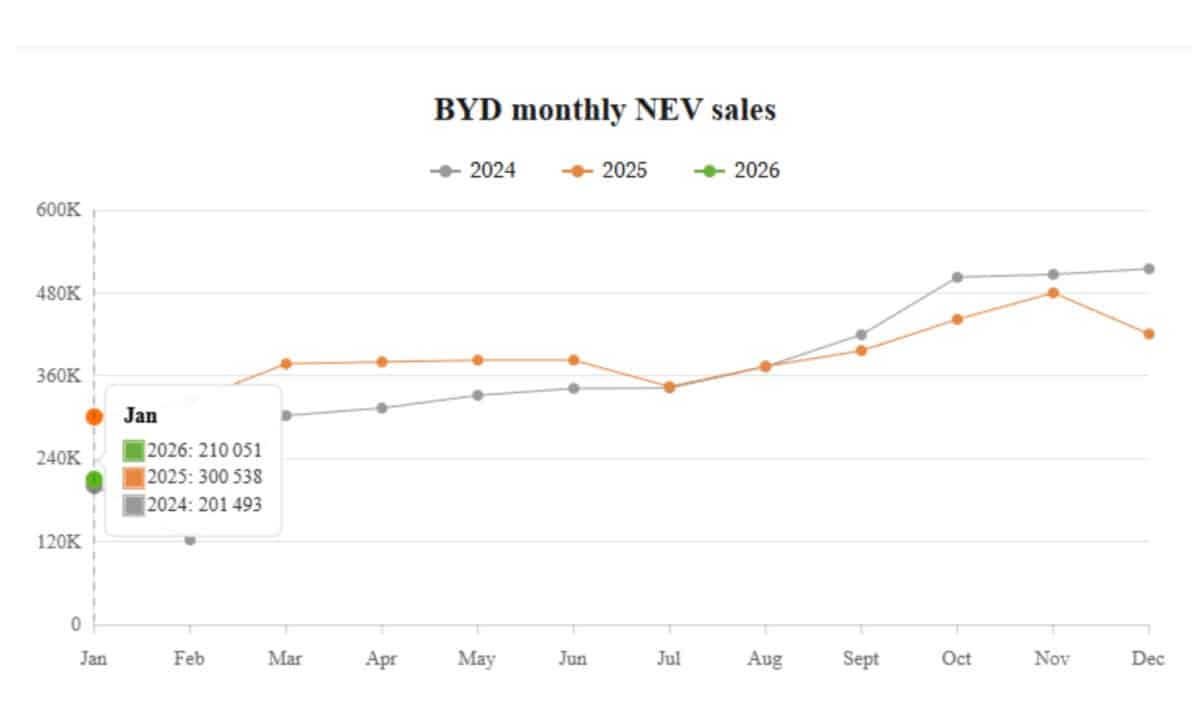

The Chinese New Year was still weeks away, but the first signs of a slowdown had already arrived. In January 2026, BYD, the world’s largest seller of electrified vehicles, saw a sharp decline in its domestic market. After a record-breaking 2025, the company’s Chinese sales of battery-electric and plug-in hybrid cars dropped by nearly 30% compared to the same period last year. A striking drop for a brand that had just overtaken Tesla in global BEV sales.

Yet, the mood at BYD headquarters is far from defeatist. What might look like turbulence on the surface may actually be the beginning of a broader international repositioning.

January Slump Reflects Structural and Seasonal Pressures

In raw numbers, BYD sold just over 210,000 new energy vehicles (NEVs) in January, a drop of nearly half compared to the previous month. Of those, 83,000 were fully electric, down more than 56% from December, while plug-in hybrids reached 122,000, also declining. This downturn isn’t unique to BYD: sector-wide data show a general pullback among Chinese EV makers in early 2026, following the end-of-year surge and ahead of Lunar New Year holidays.

But there’s more at play than just seasonality. According to Automobile Magazine, BYD is facing a triple challenge: a cooling domestic market, a tighter pricing war, and reduced government subsidies in major cities. On top of that, a new 5% purchase tax on EVs, replacing previous exemptions, has altered the purchasing dynamics. “It’s not just BYD,” notes Cui Dongshu, secretary-general of the China Passenger Car Association, “the whole market is entering a new phase of adjustment.”

Exports Rise as Europe Becomes a New Battleground

While domestic demand softened, BYD’s exports surged. The brand shipped over 100,000 vehicles abroad in January, a 51% increase year-on-year. That shift is no accident. The company has been preparing for this pivot, investing in European manufacturing and tailoring models for Western consumers.

Hungary now hosts BYD’s first European factory, currently in trial production in Szeged, and plans are confirmed for a second site in Turkey. Spain is reportedly in the running for a third plant. The aim is clear: reduce logistical dependency on China and mitigate potential trade friction with the EU. Europe’s investigation into Chinese EV subsidies is no longer a hypothetical risk, it’s a strategic factor.

The product range is evolving in parallel. The compact Dolphin is being updated for European standards. The more upscale Denza brand, co-developed with Mercedes-Benz, is set to enter the market. At the same time, models like the Atto 3 continue to spearhead BYD’s image transformation from local champion to global contender.

Diversifying Through Fleets and Ride-Hailing

While pushing outward, BYD is also hedging its bets at home. The launch of Linghui, a new sub-brand targeting fleet buyers, ncluding ride-hailing and taxi operators, is designed to counterbalance private consumer uncertainty in China. The lineup includes electric sedans and a hybrid MPV, based on existing BYD platforms.

Linghui offers not just products but a parallel distribution and service structure tailored to business clients, a segment less reactive to short-term economic cycles. This aligns with BYD’s broader aim of building stable volume channels in a turbulent market.

The move also echoes strategies used by Toyota or Volkswagen in past decades: leverage professional markets to weather dips in individual demand, while maintaining industrial output and brand visibility.

Market Leader Status Remains but No Longer Untouchable

Despite the drop, BYD retained its number-one spot in Chinese NEV sales in January. But the lead has narrowed. Rivals like Geely and Aion are making gains, and price cuts across the board are squeezing margins. What once looked like an unshakable dominance now feels more contested.

This is where global expansion becomes more than ambition, it’s a necessity. “The next decade will be about brand strength and international footprint,” said BYD chair Wang Chuanfu last year. That forecast now reads less like a vision and more like a roadmap under execution.

A Transition Within the Transition

What this moment reveals is that the EV transition isn’t linear, even for the frontrunners. BYD’s dip doesn’t signal retreat, but adaptation. It’s adjusting to the limits of domestic growth, the end of subsidy-fueled booms, and the realities of global competition.

More broadly, it shows how even the most aggressive disruptors must now think like global incumbents. With plants in Europe, fleets in Asia, and products tailored for multiple continents, BYD is no longer just China’s EV success story, it’s a case study in automotive globalization.

Whether this gamble pays off long-term remains to be seen. But if there’s one thing January 2026 makes clear, it’s that electric dominance is no longer about one market. It’s about all of them.