CEO Jim Farley recently brought up the idea of partnering with Chinese EV makers to build vehicles in the U.S., marking a potential turning point in the global electric vehicle race. The discussions, which are still in the early stages, involve allowing U.S. carmakers to collaborate with Chinese manufacturers through joint ventures, sharing both technology and profits.

If approved, this partnership could help American brands catch up to China’s rapidly advancing EV sector, which has seen major growth in recent years. However, the idea faces significant resistance, with concerns about security risks and potential job losses in the U.S. automotive sector.

China’s Dominance in the EV Market

China’s position as the world’s largest electric vehicle market is a driving force behind Ford’s proposal. In the fourth quarter of 2025, nearly 3 million battery electric vehicles (BEVs) were registered in China, a 16% increase year-over-year. This surge contributed to global EV sales surpassing 4 million vehicles for the first time.

According to Bloomberg, this impressive growth has made China the focal point for automakers seeking to stay competitive in the electric vehicle market. To that end, global companies such as Volkswagen, Toyota, Kia, Stellantis, and Ford have already partnered with Chinese EV leaders to gain a foothold in the global market.

Ford’s CEO, Jim Farley, has reportedly spoken to key figures within the Trump Administration, including U.S. Trade Representative Jamieson Greer, Transportation Secretary Sean Duffy, and EPA Administrator Lee Zeldin, about the possibility of working with Chinese EV brands. Farley’s proposal could lead to Chinese automakers building vehicles in the U.S. through joint ventures with American car manufacturers, allowing both sides to share technology and profits. However, while the idea has gained some traction, it still faces significant opposition from some parts of the U.S. government and industry.

Resistance in Washington

Although Ford is eager to pursue partnerships with Chinese EV makers, the plan is encountering resistance from key political figures in Washington. According to reports, some officials in the Trump Administration have expressed concerns about the security risks associated with allowing Chinese brands to operate in the U.S. market.

Transportation Secretary Sean Duffy, for example, has warned that the U.S. may regret allowing Chinese cars to enter the country, especially in light of Canada’s recent partnership with China to reduce tariff rates on EVs.

General Motors (GM), a direct competitor to Ford, has also voiced strong opposition to the idea. GM officials have argued that the entry of Chinese automakers into the U.S. could lead to the loss of market share for American carmakers and severely impact the domestic supply chain. GM’s concerns reflect the broader apprehension about the potential economic and job-related fallout that could result from allowing Chinese EVs to be sold in the U.S.

Global Partnerships and the Need to Compete

Ford’s pursuit of Chinese partnerships highlights the growing importance of international collaboration in the global EV market. As U.S. automakers struggle to maintain their foothold in the competitive EV space, particularly in markets like China, collaborations with leading Chinese companies such as BYD and Geely could provide a strategic advantage.

Ford is already engaged in talks with Chinese automakers. For instance, a potential partnership with BYD could involve sourcing batteries for hybrid vehicles outside of the U.S. Meanwhile, a partnership with Geely might allow Ford to utilize underutilized manufacturing facilities in Europe and share critical EV technology.

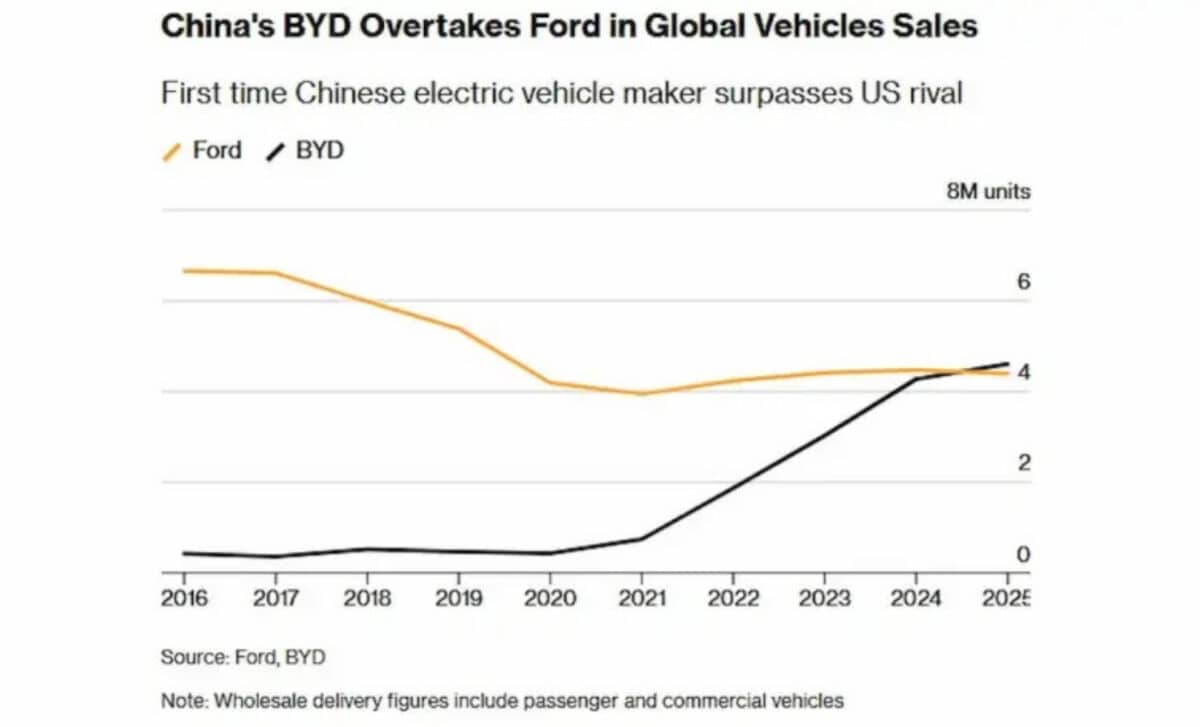

These collaborations are crucial for Ford as it faces fierce competition from Chinese EV makers, which are quickly gaining market share. In fact, for the first time in 2025, BYD surpassed Ford in global sales, with BYD reporting over 4.6 million new energy vehicles sold, compared to Ford’s 4.4 million.

Ford is also looking to innovate domestically, with plans to produce lower-cost lithium iron phosphate (LFP) batteries at a new plant in Michigan starting later this year. These LFP batteries will power new electric vehicles based on Ford’s Universal EV (UEV) platform, with the first vehicle expected to hit the market in 2027. By incorporating Chinese technology into its battery production, Ford aims to offer more affordable EV options in the U.S., with its upcoming electric pickup expected to start at around $30,000.

The Future of U.S.-China EV Partnerships

While the discussions around Ford’s proposal are still in their infancy, the potential for a shift in U.S. automotive policy is significant. If the Trump Administration greenlights this move, it could open the door for greater collaboration between American and Chinese automakers. However, the policy shift would require careful consideration of national security concerns and the broader economic impact on U.S. jobs and the automotive supply chain.

With China continuing to lead the global EV market, the question remains whether the U.S. will maintain its protective stance or adapt to the changing landscape by embracing international partnerships. Ford’s efforts to gain an edge in the global EV race may be a sign of things to come, as U.S. automakers look for new ways to compete in an increasingly interconnected world.