After setbacks tied to a fire at a key aluminum supplier, Ford is reconfiguring its production strategy for 2026. The company is expanding output of its core F-Series lineup, including the standard F-150 and Super Duty, while suspending assembly of its electric variant. Jobs will be reshuffled, plants retooled, and production lines pushed harder—all in the name of meeting demand and recovering from financial losses.

This recalibration lands at a crossroads between electrification ambitions and economic realism. As demand patterns shift and material shortages linger, Ford’s move signals a deliberate step back from EV overextension, in favor of what still sells—and what it can still build.

Electric Ambitions Put on Ice

Ford’s decision to halt F-150 Lightning production indefinitely underscores a pivot away from electrification, at least for now. The electric pickup had been positioned as a cornerstone of Ford’s EV rollout, but, according to Carscoops, the model has “not lived up to expectations.”

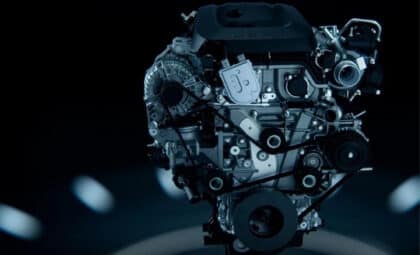

Instead, Ford is leaning into what still works: trucks with combustion and hybrid drivetrains. These are not only more profitable but also require less aluminum—an important detail in the wake of a fire at the Novelis aluminum plant that disrupted the supply of materials used in truck manufacturing.

As part of the reshuffle, hourly employees at the Rouge Electric Vehicle Center will be transferred to the nearby Dearborn Truck Plant, where a third shift is being introduced to boost F-150 output. The Lightning, meanwhile, remains stalled without a clear return date.

Massive Production Boost at Dearborn and Kentucky

Ford will add over 45,000 more F-150 units to its production total next year by expanding operations at its Dearborn Truck Plant. A third shift, composed of approximately 1,200 workers, will be deployed, supported by an additional 90 jobs at Dearborn Stamping and 80 more at Dearborn Diversified Manufacturing.

The company will also channel $60 million into the Kentucky Truck Plant to boost production of its Super Duty pickups. The funding will accelerate the line to produce one extra truck every hour—a seemingly modest gain that translates to over 5,000 additional vehicles per year.

The investment will also help train incoming workers, with over 100 new hires expected to join the Kentucky facility. Ford’s Chief Operating Officer, Kumar Galhotra, framed the move as a response to real-world demand: “The people who keep our country running depend on America’s most popular vehicle – F-Series trucks.”

Fallout from Aluminum Plant Fire Lingers

The deeper cause behind Ford’s strategic shuffle lies in the fire at Novelis, a major supplier of aluminum for the automaker. The blaze shut down part of the production process and disrupted Ford’s ability to source and shape the material needed for its truck bodies.

The financial hit from this single event could reach up to $1 billion between 2025 and 2026. In the meantime, Ford is working with Novelis to make use of the surviving sections of the plant, especially the cold rolling line, in an effort to keep material flowing and damage contained.

Despite the disruption, Ford’s third-quarter numbers remain solid. The company reported $50.5 billion in revenue—a 9% increase year-over-year—and net income of $2.4 billion. Adjusted EBIT is expected to fall between $6 billion and $6.5 billion, while adjusted free cash flow is forecast at $2 billion to $3 billion. But under the surface, the company is clearly bracing for more turbulence.