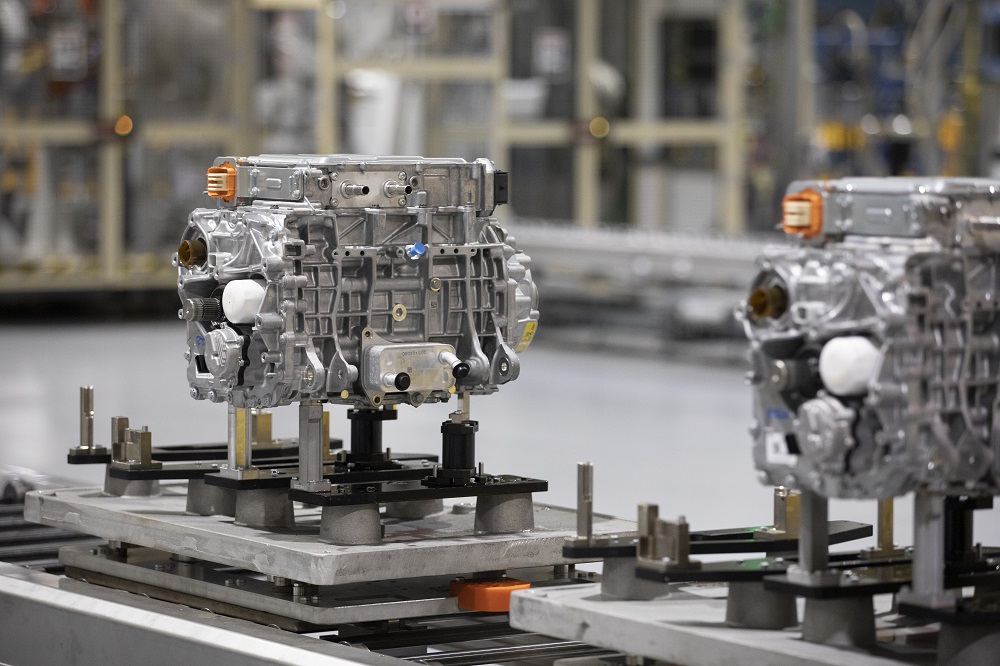

Photo: Ford

Photo: Ford

The CEOs of Ford, General Motors, Toyota Motor North America, and Stellantis have all signed a letter to Congress urging the nation’s leaders to lift the cap on the $7,500 electric vehicle tax credit. Currently, customers can benefit from this credit when purchasing an EV in the United States, but this incentive expires after the manufacturer has sold 200,000 qualifying models.

GM and Tesla have already hit the EV tax credit cap while Toyota, Ford, and Volkswagen are all anticipating to reach it soon, meaning that customers seeking to buy from these brands will no longer be able to take advantage of the major discount.

F-150 Lightning: Ford’s hot EV pickup already gets a power bump

Automakers say that without the incentive — and in part because of the ongoing economic crisis and global supply chain issues — EV development and adoption will fall even further behind the EU and China, where government subsidies are only ramping up. Industry experts believe it could also lead to fewer U.S. jobs and increase America’s long-term dependence on foreign countries for EV parts.

“To provide greater consumer choice, we ask that the per-OEM cap be removed, with a sunset date set for a time when the EV market is more mature,” the letter urges. “Eliminating the cap will incentivize consumer adoption of future electrified options and provide much-needed certainty to our customers and domestic workforce.”

Last year, President Biden proposed a bill that would have done exactly as they asked and lifted the EV tax credit cap. However, the bill also included an extra $4,500 incentive for union-made, U.S. assembled vehicles. It was thus opposed by Tesla, Toyota, Volkswagen, Honda, and other automakers with (surprise!) non-union labor.

Now, automakers are racing to get the incentive extended before Republicans, who have been almost universally opposed to EV subsidies, threaten to sweep the 2022 midterm elections. But they face resistance on both sides of the aisle.

In April, Senator Joe Manchin, a Democrat, argued that it “makes no sense” the government should help consumers buy EVs when manufacturers already can’t keep up with the demand. “It’s absolutely ludicrous in my mind,” he said. Meanwhile, Republicans have pointed out that the existing EV tax credits are largely benefiting taxpayers earning more than $100,000.

Automakers are now lobbying hard to gather support in Congress. But come November, those who opposed President Biden’s EV tax credit in 2021 may come to regret having taken that stance.

Kurt Verlin was born in France and lives in the United States. Throughout his life he was always told French was the language of romance, but it was English he fell in love with. He likes cats, music, cars, 30 Rock, Formula 1, and pretending to be a race car driver in simulators; but most of all, he just likes to write about it all. See more articles by Kurt.