Volkswagen has confirmed that small gas-powered cars like the Polo are heading for extinction. The brand will discontinue future development of compact internal combustion models as regulatory pressure and economic challenges make them financially unfeasible.

Even though the European Union has softened parts of its 2035 combustion-engine ban, automakers are still required to meet steep emissions reduction targets. For VW, the pivot to electric isn’t about consumer demand, it’s about hard numbers and rising production costs.

Emissions Regulations Accelerate Transition

Europe’s auto industry remains under tight scrutiny, even with recent flexibility in emissions legislation. New fleet rules require a 90% cut in emissions from 2021 levels, well before 2035. From 2030 onward, even stricter CO₂ limits will apply, effectively tightening the noose around internal combustion engines.

In an interview with Auto Motor und Sport, VW brand CEO Thomas Schäfer explained that small gas cars no longer make financial sense. Developing a new combustion engine vehicle that complies with upcoming standards would cost too much. These expenses would be passed on to customers, making the cars significantly more expensive and eroding their main appeal: affordability. “The future in this segment is electric,” Schäfer stated.

The Polo Will Live On as an Electric Vehicle

This decision means that B-segment gas-powered models like the Polo are on their way out. While the Polo is not being pulled from production immediately, VW has made it clear that its eventual replacement will be fully electric. Plans are in motion for an ID. Polo, which would serve as an indirect successor and preserve the model’s spirit without its fuel tank.

Volkswagen also ruled out a return to A-segment cars such as the Up! or the Lupo. Schäfer said there’s no interest in reviving ultra-small combustion-powered models when relatively affordable electric cars are set to enter the market.

New Electric Lineup Aims for Accessibility

Volkswagen’s first compact EV, comparable in size to the Polo, is expected to launch next year at a starting price of $27,500, including VAT. In 2027, the production version of the ID. Every1 concept will aim to bring the price point down to $22,000. In some EU countries, government incentives could reduce those figures even further for buyers.

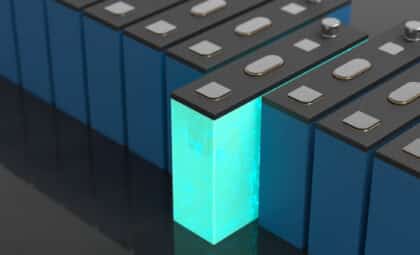

A Polo-sized electric crossover, previewed in the ID. Cross concept, is also in development. All three vehicles, the ID. Polo, ID. Every1, and ID. Cross, will be built on the MEB+ platform, designed exclusively for electric vehicles.

Combustion and Electric Models Will Coexist Temporarily

Although the long-term direction is firmly electric, Volkswagen isn’t making an immediate break. Existing gas-powered models like the Polo and T-Cross will continue to be sold alongside their electric counterparts. The company has not set official end dates for these models, but the transition is clearly underway.

Despite skepticism about EV demand, Volkswagen remains strong in the European market. According to the European Automobile Manufacturers’ Association, the company recorded over one million vehicle sales in the EU in the first ten months of 2025. Including the UK and nearby markets, that total exceeds 1.2 million units.

Meanwhile, the appetite for electric vehicles appears to be growing. By October 2025, EVs accounted for 16.4% of EU car sales, up from 13.2% the previous year. If Volkswagen’s plan succeeds, its new fleet of affordable electric vehicles may not just replace small gas cars, they might make their departure feel inevitable.