Auto executives are grappling with a patchwork of trade policies, subprime lending stress, and production disruptions, all while trying to stay profitable amid a shifting electric vehicle landscape. The next set of earnings may reveal just how thin the margin for error has become in Detroit.

Automakers entered 2025 weighed down by inflation, trade tension, and regulatory reversals. CEO Jim Farley of Ford bluntly described the situation earlier this year as “a lot of cost and a lot of chaos.” While the worst-case scenarios haven’t played out, industry insiders remain cautious. Barclays upgraded its outlook for the sector from negative to neutral in September, noting that the industry had “held in better than anticipated.”

Still, the optimism is tempered. According to a recent analysis by S&P Global, the burden of tariffs has eased somewhat, but other headwinds persist—namely softening consumer confidence, slower disposable income growth, and the added uncertainty of a government shutdown. That combination is setting a tense backdrop for a potentially volatile earnings week.

Resilience Masks Uneven Stress Across the Supply Chain

Despite the ongoing turbulence, U.S. auto production and sales figures have outperformed expectations through the third quarter. Analysts from Wolfe Research noted on October 10 that industry production “came in better than expected,” even as most companies are expected to post double-digit drops in adjusted earnings per share.

According to CNBC, this resilience has been partly driven by steadier consumer spending and less severe fallout from tariffs than anticipated. Yet, the situation is far from stable. A fire at Ford’s aluminum supplier Novelis in September is projected to cost the company between $500 million and $1 billion in operating income—an example of how production can be derailed by a single disruption.

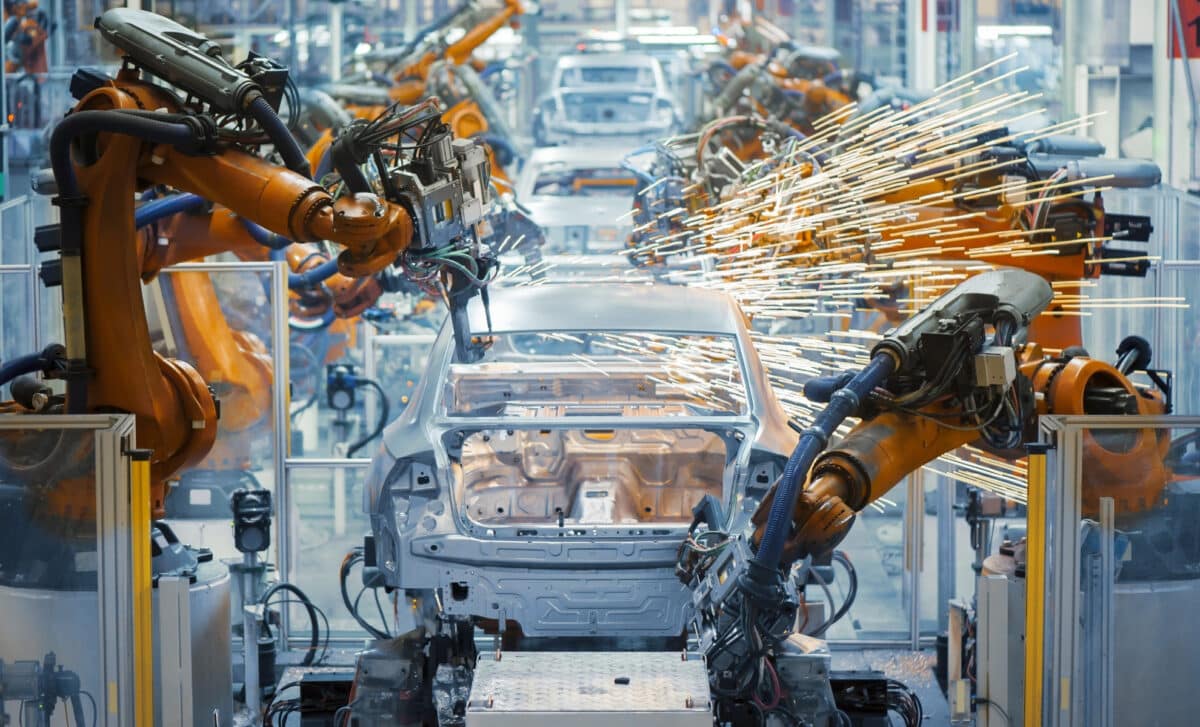

In the supplier world, the pressure is even greater. Thousands of companies—ranging from small operations to giants like Aptiv, BorgWarner and Dana—form the intricate web supporting automakers. According to MEMA, the vehicle supplier association, many of these firms cannot endure further cost increases. The bankruptcy of First Brands Group, a major U.S. parts maker, sparked additional concern on Wall Street, highlighting the fragility of the current private credit environment.

Electric Vehicle Optimism Gives Way to Course Correction

The industry’s pivot toward electric vehicles, once a pillar of growth narratives, has started to look shakier. Last week, GM disclosed $1.6 billion in special charges tied to its pullback in EV investment, underlining how expectations have shifted. Analysts at UBS said that many of the financial losses tied to EV development and tariffs have already been baked into estimates for 2025 and 2026, but the uncertainty remains high.

According to Harvard University’s Elaine Buckberg, formerly GM’s chief economist, “The industry is in a lot of flux,” and the last seven years have brought a level of volatility that defies historical comparison. Automakers are now trying to strike a balance—absorbing some cost shocks, adjusting EV strategies, and preventing fallout across their complex supplier networks.

Meanwhile, Tesla, Ford, and GM are still expected to remain profitable on an adjusted basis, but the numbers may not be enough to satisfy investors if broader momentum appears to be fading.

Consumer Divide Deepens as Tariffs Loom over 2026

Consumer behavior remains a key question mark, particularly as the industry watches for signs of stress beyond the luxury segment. Auto lending executives, especially in the used vehicle space, have sounded alarms about financial strain among subprime buyers. According to Fitch Ratings, 6.43% of subprime auto loans in August were over 60 days delinquent—a figure hovering near record highs set earlier in the year.

CarMax CEO Bill Nash said earlier this month that lower-income consumers are already distressed, a trend confirmed by Cox Automotive’s Jonathan Smoke, who pointed out that stress is mostly visible among households with incomes below the U.S. median of $83,730. Those in the upper-income bracket, who make up two-thirds of new vehicle purchases, are still largely unaffected by higher costs and rate volatility.

Still, many in the industry suspect this balance may not hold. As stated by Morningstar analyst David Whiston, “Everyone in the industry is assuming consumers are going to start to get tariffs passed down to them for autos. They haven’t really yet.” The moment that dynamic shifts, companies may face a far more complicated consumer environment.